Vanishing Inflation Brings Joy to Investors

“It’s always darkest before the dawn”, a phrase coined by English theologian Thomas Fuller in 1650, is appropriate to summarize price action over the past four months. Equity markets fell 9% between August and October and the U.S. Treasury Bond’s 10-year yield dramatically rose through 5%. Enter November and the S&P 500 recorded its best month of the year, gaining 9.2%. The MSCI All Country World Index grew 9.0%, while the TSX lagged, improving 6.7%. For the Canadian benchmark, Energy and Commodities didn’t participate in the catch-up trade as much as the Tech heavy U.S. indices. We have repeatedly highlighted the inverse relationship between risk assets and the U.S. dollar. As such, it was little surprise that the equity market’s increase coincided with a 2.6% pullback in the DXY. Whereas the previous three-month stanza was characterized by a stubbornly strong greenback as stocks descended without much resistance.

A recovery in bond prices was welcome news for those who have been battered in the fixed income market since 2020. The iShares 20-Year Treasury Bond ETF (TLT) touched a low on 19-Oct-23, but it has since bounced more than 10% higher. While it is never any one thing, we can always try to put the puzzle together. In this instance, substantive easing of inflation and vanishing expectations for rate hikes in 2024 are key pieces. The October Bureau of Labour Statistics reported that CPI rose 3.2% annually, and 0.2% month-over-month. Core CPI also registered its smallest annual change since September 2021. Accordingly, with readings consistently below economic forecasts, the market is now pricing up to five cuts in the Federal Funds Rate in 2024. Rate decreases cause bond prices to rise, which explains the strong bond performance in November. Similarly, a lower yield on cash makes a country’s currency comparatively less attractive, which justifies the large fall in the U.S. Dollar Index (DXY). The Goldilocks market was supported by a 3Q23 GDP print in the U.S. that beat expectations, rising 5.2% versus the prior 4.9% rating. Falling inflation and rising GDP is the ideal scenario for an “everything rally” in asset prices, but it is unlikely the Federal Reserve will embark on an aggressive easing policy in the absence of a large increase in unemployment and/or slowdown in the economy.

Price movements across commodities will become an important variable in this environment. Theoretically, loosening Fed policy absent a recession should lead to rising commodities as the U.S. dollar will remain weak while growth endures. Commodities are a major input for most goods, making these a key contributor to inflation. As such, firming commodity prices will underpin inflation and potentially influence monetary policy tightening. Through late October and November most commodities, with the exception of oil (down 6.8%), started to form the appearance of a short-term foundation in price.

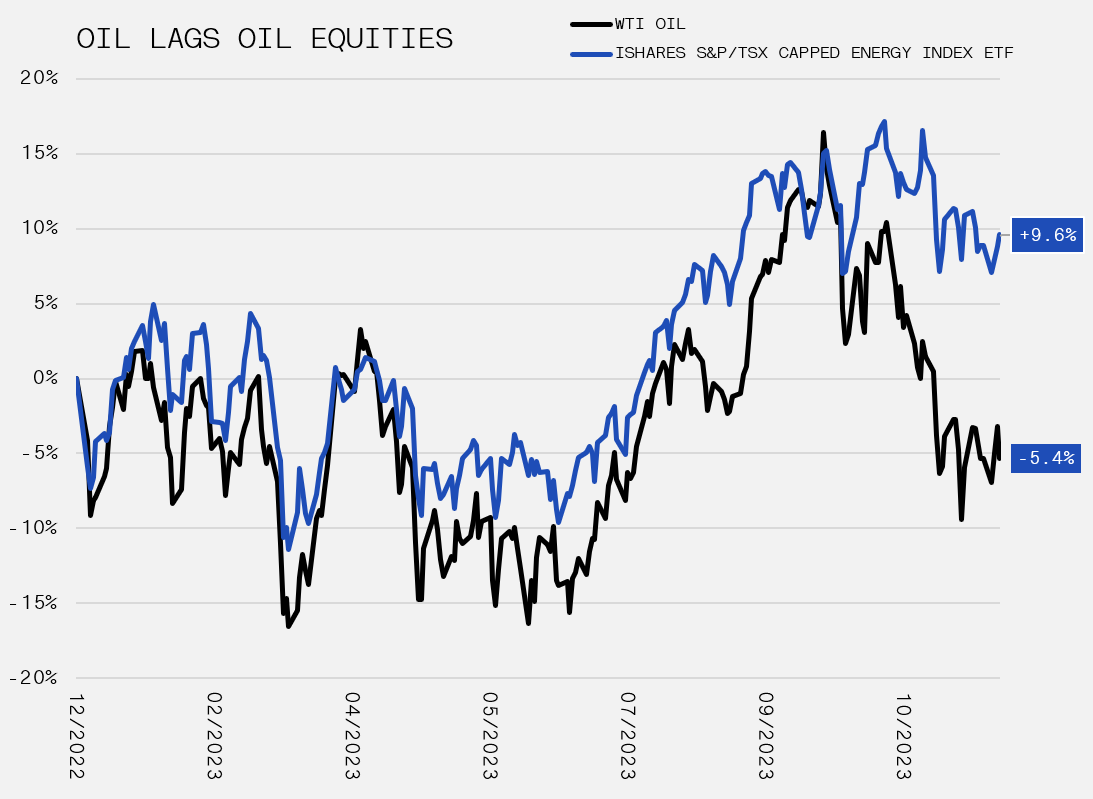

Despite a manageable 5% year-to-date decline in the WTI Crude Oil price, energy investors who expressed their position through Canadian energy stocks have gained approximately 10%. Capital has flowed back into the sector due to improved cash flow discipline, durable balance sheets and a healthy price for the underlying commodity. Elsewhere, Gold rose 2.1%, buoyed by the combination of falling yields and the sliding U.S. dollar. Copper had a notable lift of 4.7% in November. Previously, the metal descended roughly 15% from its 2023 peak in mid-January through October. Copper is often a bellwether for global growth, so a follow-through to the upside as the calendar winds down could demonstrate optimism for the New Year.