On a Heater

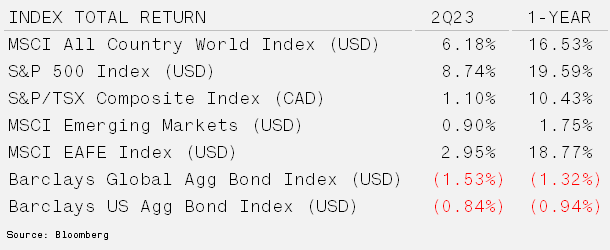

Equities Remain Best In Class – The second quarter was positive for equities as regional bank concerns faded and headline inflation fell to 4%. Equities remain quite bifurcated, as most of the gains have come from just seven stocks. The shares of Nvidia, a manufacturer of computer chips, rallied 52% in Q2 and 189% through the first half of the year. The majority of those stocks are believed to be beneficiaries from widespread adoption of Artificial Intelligence. However, negative sentiment and over-positioning due to a manufacturing/industrial slowdown have played a major role.

Bonds finished the quarter lower, despite cooling inflation in the United States and most developed economies. The U.S. yield curve became even more inverted through June, as the 2-year Treasury Note’s yield was over 100 basis points higher than the 10-year. Commodities also declined 3% during the quarter, as measured by the Bloomberg Commodities index.

Is the Paradigm Shift for Real? – In three short years, the financial landscape has shifted dramatically. The U.S. Federal Reserve pivoted its messaging from “transitory” inflation, meaning no reason to increase short-term borrowing rates, to hiking at the most aggressive pace in history. While we have hit a slowdown in hikes following the Silicon Valley Bank collapse, messaging from the head of the Federal Reserve, Jerome Powell, suggests that the focus to contain inflation remains.

From November 2021 through October 2022, short-term borrowing rates increased by roughly four percentage points. This forced leveraged players in financial markets to adjust their strategies and U.S. homeowners to settle into their current home as most locked in sub-3% rates on 30-year mortgages. It appears however that both segments are adjusting to the new normal. Gross positioning for hedge fund managers is in the 99th percentile at 258% and net exposure is 69%, in the 83rd percentile. Meanwhile, tight supply of existing homes for sale has pushed transactions for new homes and the pace of housing construction starts back to the trend set from 2009.

The resiliency of both markets has had a positive effect on the economy. The growth rate, while slowing, came in better than expected at 1.8% year-over-year in the first quarter of 2023. Higher than expected growth has coincided with falling inflation. When combined with a quick bailout of Silicon Valley Bank and negative positioning, global equities quickly reversed their bearish trend.

With the strength of the economy, Jerome Powell is likely to resume interest rate increases. Bringing inflation down to 2% remains the Federal Reserve’s top mandate, so long as employment remains strong, as it has. Headline inflation has dropped faster than core inflation, as more volatile items like food and energy are excluded from core inflation. These items however are a major burden to most citizens, and they have turned higher recently. Shelter, transportation, and medical care prices continue to increase year-over-year at a rate much higher than desired (over 4%+). As necessities, this will likely force the Federal Reserve to lean into more rate increases.

Short-term rates are a function of policy setting, however longer-term interest rates reflect the economy. Supply for bonds is set to remain elevated following the debt ceiling increase. With the US Treasury set to issue over $1.3 trillion over the next year through bonds and bills, the composition will be key as any uptick in longer-term bond issuance will raise rates, which will be more impactful to markets. This is occurring at a time when government elections are around the corner and fiscal spending on tangible items will have a meaningful impact on growth (GDP numbers). Furthermore, it is possible that an investment boom powered by the combination of an election year, reshoring and defence spending will boost the long-term growth trend.

It appears that rates, and the cost of capital, are set to remain elevated. We are comfortable with a diversified portfolio that remains underweight duration, liquid and invested in quality businesses as we tread into what appears to be a policy shift from the last decade.