The Comeback Kids

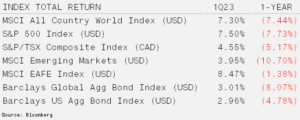

Back-to-Back Positive Quarters – Despite the second largest banking failure in U.S. history, sticky inflation and continued interest rate hikes in the U.S., investors drove stock prices higher in the first quarter of 2023. The beaten-down technology and communications services stocks lead index performance, with Nvidia up 90.1%, META jumping 76.1% and Fastly posting a 116.8% gain. Although inflation remains high, the rate of change is lower, which has fueled the narrative around easing rate hikes or even a “soft landing” by the economy. The quarter ahead appears to be a battle between negative market positioning and weakening corporate earnings.

Global bonds advanced as investors began to pick up on the effects of higher interest rates and uncertainty with the financial system overall. The U.S. Federal Reserve maintained its hiking policy through the quarter but hinted at a possible pause going forward, while the Bank of Canada held rates steady in its latest meeting. Gold was another beneficiary of the flight-to-safety, returning nearly 7% during the quarter.

Can Equities Stave Off a Slowdown? – The Stanley Cup playoffs have been entertaining to say the least as teams refuse to roll over and have erased three goal deficits on a nightly basis. Similarly, equity markets have found themselves on the wrong side of the ledger, only to turn it around with back-to-back positive quarters. This is despite poor growth numbers, bank loans collapsing and money supply contracting. Yet, corporate spreads refuse to widen in a meaningful way and equities are no longer making new lows for the cycle. This suggests there is some fight left in the economy that has been written off by many.

While credit default swaps (insurance against a credit event) have taken off for numerous banks as well as U.S. Treasuries, corporate spreads have held in much better then expected. There are a few possible explanations for this, the primary one being corporate margins, while off the highs, remain elevated relative to historical averages. Another possible explanation is that the wall of debt maturities does not become significant until 2025. Therefore, while earnings may be slowing, corporations are still earning healthy profits while benefiting from low interest payments. Companies that have avoided bloating their balance sheets have fared much better than over-levered and/or low margin businesses. Consumers also appear to be adjusting to higher rates for now.

The U.S. dollar traditionally increases relative to its trading partners during recessionary periods. The theory is, and empirical evidence supports, that the U.S. is the strongest and deepest market globally. Therefore, the reserve currency’s recent performance, declining over 12% since September 2022, caught many market participants by surprise. The cyclical factors that contributed to the weakness are (1) the prospect for a shift to looser monetary policy (2) the dichotomy in growth as the Asia Pacific countries in particular look better positioned. Structural factors are also contributing to pressure on the greenback. High debt levels seem to have foreign investors concerned as investment from abroad has slowed. This long-term effect along with increasing momentum towards de-dollarization appears to be accelerating. A lower U.S. dollar helps global growth as commodities and debt obligations denominated in greenbacks become more affordable, but it also makes foreign goods more expensive for Americans.

The backdrop still has a bearish tilt, as we highlighted in our 2023 Outlook, but there are pockets of reprieve. The crucial period will be first and second quarter corporate earnings. Companies with pricing power will be able to preserve their profit margins and those with strong balance sheets will have flexibility to navigate the higher interest rate environment. Further slowdowns in the economy will likely be met with a Federal Reserve pivot to looser monetary policy which should stem further earnings erosion. A weaker dollar helps commodity-related equities as well as global earnings. Finally, gold remains a beacon of stability. It has no credit risk and its price is typically negatively correlated with interest rate movements.