Most Stocks Sleep But A.I. Fattens a Few

The S&P 500’s 0.8% return in May will mark the first time since June-August 2021 that the index has posted three consecutive positive months. Gains accumulated in the S&P 500 and Nasdaq as investor flows continue to pour into large cap technology companies. The MSCI World was flat and the TSX fell 3.2%. The Canadian benchmark suffered due to struggling commodities and disappointing quarterly earnings from banks amid higher provisioning for credit losses and a difficult funding environment. While equity markets remain strong, about every market outside of stocks has had the opposite experience. Starting with the bond universe, whether it is the ongoing debt ceiling debate or concerns about stagflation, bonds sold off across the curve with TLT (iShares 20 Plus Year Treasury Bond ETF) falling 4.8% during the period. The yield increase was more pronounced at the short end as inflation and a stubbornly strong job market pressures the Fed to maintain a tight policy despite a challenging regional banking environment. Even Canada’s CPI rose 4.4% in April marking its first acceleration in headline inflation since June 2022. This combination of underlying economic pressures removing any hope of an imminent Fed reversal and a short bias in investor positioning pressed the U.S. Dollar Index (DXY) upwards by 2.5%.

The simultaneous rise in bond yields and the U.S. dollar led to a sharp pullback in gold, falling 2.2% in May. However, the impact was not just confined to one commodity. WTI Oil dropped over 5%, though it was down as much as 10.5% earlier in the month. Bullish inventory data and warnings directed at speculators from OPEC helped stabilize oil prices. Copper, on the other hand, was unable to find support, and is now down over 20% year-to-date. Similarly, there has been no underpinning for grains, as wheat and corn both sank 0.5% and 4.8%, respectively. Widespread commodity weakness, while certainly a victim of U.S. dollar strength, is also a reflection of an anemic outlook for global growth. Weak price action in industrial metal can be explained partly by a delayed re-opening in China. A quicker rebound was expected when China suddenly abandoned the strict COVID-zero policy in December. Unfortunately, an estimated 900 million new cases in just weeks have renewed fears.

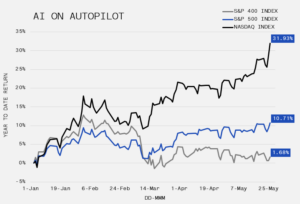

While headline equity readings appear to contrast with the signaling from commodity prices, there is a subtle connection beneath the surface. The chart below shows the year-to-date returns for the Nasdaq, the S&P 500 Index and the S&P 400, an index of 400 U.S. mid-cap companies.

Despite overall equity strength, the average U.S. company is just eking out a gain for the year. Most of the gains have accrued to larger tech-focused companies, as evidenced by Nasdaq’s remarkable display. Much of this came from NVIDIA, a U.S.-based semiconductor company that has embraced the Artificial Intelligence (AI) hype through its focus on data science and graphics processing units (GPUs). NVIDIA, already the fourth largest weight in the S&P 500, rose an astonishing 30% after-hours following its 1Q23 announcement, adding the equivalent of Costco’s market cap in a single day. As the prospects of widespread AI adoption control the narrative, flows have followed, pushing the Nasdaq to 3.3 standard deviations above its 50-day moving average, its most overbought reading since January 2004. Prolonging the advance in equities will require broader participation beyond the giants (Nvidia, Apple, Microsoft, Alphabet and Amazon) who represent 96% of the $3 trillion gains in the S&P500’s market value in 2023, according to Fortune.